Online banking is becoming increasingly popular. Intuitive designs on websites and apps make the entire process simple and worry-free. If you’re interested in online banking, be sure to consider using CIT Bank.

Online banking is becoming increasingly popular. Intuitive designs on websites and apps make the entire process simple and worry-free. If you’re interested in online banking, be sure to consider using CIT Bank.

CIT Bank is an online-only bank that offers some of the highest Savings and CD rates in the nation. They are known for their Savings Account and CD options, and rates are consistently at top of the market nationwide.

If you’re already interested, visit CIT Bank Savings Builder to earn up to 0.45% APY.

CIT Bank Savings Account

Customers can get up to 0.45% APY with their new online savings accounts.

- $100 minimum to open

- There are no opening, monthly servicing, online transfer or incoming wire fees.

How To Get This Rate

These are the current requirements to receive their highest APY rate: maintain a balance of $25,000 or deposit $100 into your account per month.

Here are the rules according to CIT Bank:

- Monthly Savers:

- Make at least one single deposit of $100 or more during the first Evaluation Period which begins on the third business day prior to the end of the month the account was opened.

- Additional deposits made between the account opening date and the beginning of the first Evaluation Period will not qualify.

- In order to continue to earn the higher rate, make at least one single deposit of $100 every month.

- High Balance Savers:

- Have an account balance of $25,000 or more on each Evaluation Day. The Evaluation day is the fourth business day prior to the end of the month.

Rate Tiers

Base: <$25,000 – 0.29%

Upper: < $25,000, but with monthly deposit of $100 or more – 0.95%

Upper: > $25,000 – 0.45%

0.79% APY assumes the account is opened on the 15th day of the month and no qualifying deposits of $100 are made following account opening. Actual APY may be greater or less depending on the date the account is opened. See site for details.

CIT Bank Money Market Account

CIT Bank now offers money market accounts. Going at a rate of up to 0.50% it’s near the top of highest rates. This account is basically a liquid savings account that pays a variable rate of interest and allows up to 6 transfers, deposits, and withdrawals per monthly statement cycle which is governed by federal regulation.

Currently customers can get rates up to 0.50%

- Rate offer has no listed expiration date, but is variable and may change at anytime.

- CIT Bank Money Market account is eligible for this offer

- Offer is available online, nationwide

- Minimum opening deposit of $100

- No Monthly Service Fees

- FDIC Insured

- Use People Pay to send money from your Money Market account to almost anywhere with an email address or mobile phone number.

Learn more about CIT Bank Money Market Account

CIT Bank CD Accounts

There are a variety of CD Options:

- Term CDs

- No-Penalty CDs

- Jumbo CDs

Depending on the amount you can deposit, Term CDs are best for lower deposits. Jumbo CDs are best for deposits of $100,000 or more.

Term CDs

- Minimum deposit of $1,000

- Available terms: Short-term 6-Month and 1-Year CDs to their longer term 5-Year CDs

- Daily compounding interest to maximize your earning potential

- No account opening or maintenance fees

- FDIC insured

Earn up to 0.50% per term. See full list here.

No Penalty CDs

- Minimum deposit of $1,000

- You may withdraw the total balance and interest earned, without penalty, beginning seven days after funds have been received for your CD. No withdrawals are permitted during the first six days following the receipt of funds

- No account opening or maintenance fees

- Daily compounding interest to maximize your earning potential

- FDIC insured**

Earn up to 0.30% per term. See full list here.

Jumbo CDs

- Minimum deposit of $100,000

- No account opening or maintenance fees

- Daily compounding interest to maximize your earning potential

- FDIC insured**

Earn up to 0.50% per term. See full list here.

Bottom Line

When considering Savings account rates, CIT Bank is a definite consideration. Thanks to the ability to strictly stick to online banking, CIT Bank cuts costs that would be used on physical locations. Their savings are then directed towards their customers who get to receive some of the highest rates.

If you’re interested, visit CIT Bank to sign up and learn more!

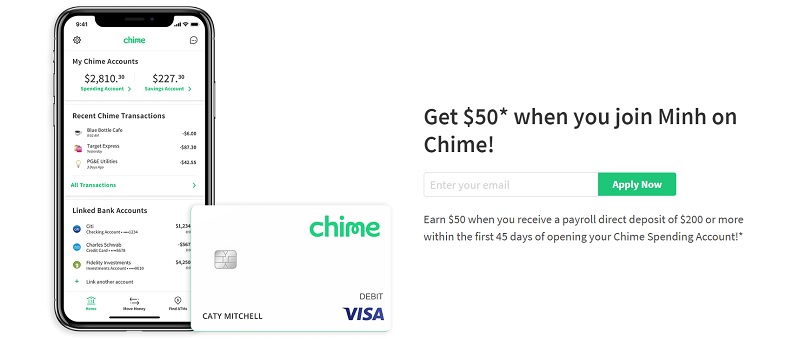

Chime Prepaid Card Promotion

Chime Prepaid Card Promotion