There are many investment advising firms out there. You have Robo-Advisors that give a cheap robotic algorithm based advice towards your investments. Then you have Personal Capital. This investment firm uses both robo-advisor’s algorithms and human advisors. This gives their customers the best hands-free experience.

There are many investment advising firms out there. You have Robo-Advisors that give a cheap robotic algorithm based advice towards your investments. Then you have Personal Capital. This investment firm uses both robo-advisor’s algorithms and human advisors. This gives their customers the best hands-free experience.

Account balances of $200,000 or more get assigned two dedicated financial advisors; those below that have access to a team of advisors.

That high-touch approach comes with high account management fees: Personal Capital charges 0.89% per year, though large account balances — $1 million or more — earn discounted rates.

Apart from their managed account services, they offer a handful of financial and investment tools that are completely free. In addition, they’ve recently released a socially responsible strategy, available with no added costs.

If you’re already interested, be sure use our referral link when signing up to receive a $20 bonus. This bonus can be used towards future investments.

Contents

Personal Capital Pros

- Personal Capital is perfect for high net worth investors. They give them 2 dedicated advisors along with the computational algorithm.

- Personal Capital gives their clients a hands free experience. As a result, they get to sit back and watch their money grow.

- Personal Capital helps optimize your taxes.

- They give out free financial management tools to their users. If customers like a more hands-on experience and want to do some of the work themselves, they offer tools to help you do just that for free!

Personal Capital Cons

- Management Fees: With all the dedicated help from both robo-advisor algorithms and human advisors, it’s hard to keep the price down. Accounts with balances under 1 Million dollars will have to pay a rate at 0.89% per year. In comparison, other services like Robo-Advisor won’t charge more than 0.25%. Even other hybrid-system services like Vanguard Personal Advisor charge around 0.30%.

- Account Minimum: At one time, Personal Capital’s account minimum was a more-reasonable $25,000, especially for a hybrid service that includes access to financial advisors. However, it’s since raised that minimum back to $100,000, once again putting the wealth management service out of reach for many customers.

Where Personal Capital Shines

Investments: Personal Capital’s paid services fall into two tiers: Clients with $100,000 to $200,000 in assets are invested in a portfolio of exchange-traded funds that carry a weighted average expense ratio of 0.08%.

Clients with balances of $200,000 or more get invested into a special customized portfolio that includes individual securities through a process it calls Smart Indexing. This process invests equally in all sectors, rather than mimicking an index like S&P 500.

This process has outperformed S&P 500 by 1.5% annual and offers more returns without the risk – something all investors love.

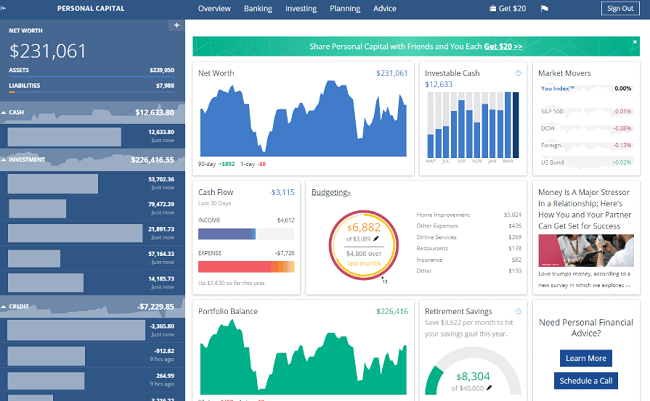

Tools: Clients get to use their free comprehensive tools that include investment checkups, 401(k) fee analyzer, and a spending tracker. These tools are frequently used to help optimize how much one can spend and still pay off fees and taxes.

To help emphasize, all these tools are available for free. Yes, you still need to create an account with Personal Capital, but no enrollment is needed.

Once you sign up, you can quickly link your bank, brokerage and credit card accounts. Personal Capital analyzes the asset allocation in your investment accounts based on the information it finds, telling you exactly how much you need to decrease or increase your holdings of certain asset classes to line up with its recommended target.

Bottom Line

Is Personal Capital for you? Their services attract clients from opposite ends of the spectrum. Self investors who are able to use their free tools to help plan and optimize their spending and high balance investors who are able to put down $200,000 and let the dedicated members and algorithms do the work for them.

We strongly believe that Personal Capital is a great investment advisor service. They should definitely be used towards planning and future investments.

If you’re interested, be sure to sign up through our referral link to receive a $20 bonus. This bonus can be used towards your future investments!

Leave a Reply