Competitor to Robin, WeBull is another mobile app-based brokerage offering free trading on their enhanced platform. WeBull stands out thanks to their innovative platform and wide range appeal from both experienced self investors and beginner investors. Their design accommodates their users with easy to read charts and tools used to make decisive investments.

Competitor to Robin, WeBull is another mobile app-based brokerage offering free trading on their enhanced platform. WeBull stands out thanks to their innovative platform and wide range appeal from both experienced self investors and beginner investors. Their design accommodates their users with easy to read charts and tools used to make decisive investments.

There is no minimum balance required to open an account for regular investing. However, accounts that participate in marginal trading must maintain a balance of $2,000 or more. Falling under $2,000 will cause forced liquidation of all stocks.

If you’re already interested, be sure to create an account using our referral link! Signing up with this link will grant you a free stock valued between $5-$100!

Commissions and Fees

One main appeal to WeBull is commission-free trading to over 500 stocks and ETFs. Webull does not currently offer options trading. There are no account maintenance fees or software platform fees. However, SEC and FINRA fees along with margin rate fees will apply to trades.

U.S. market is free and real-time. However, international stocks require subscription based payments to acquire real-time data.

Wire Transfers

Outgoing domestic wire transfers cost $25-per transaction. Incoming domestic wire transfers are $8-per transaction after the free initial transfer. However, incoming wires over $25,000 are free of charge.

Outgoing international wire transfers cost $45-per transaction. Incoming international wire transfers are $14-per transaction after the free initial transfer and incoming wires over $25,000 are free of charge.

WeBull Platform

WeBull is packed with tools and charts that are easy to read and filled with vital information. These tools help experienced investors make crucial decisions.

Both fundamental and analytical data can be found on their platform through innovative designs and intuitive features.

For now, WeBull is purely mobile-based and no web/online platform can be accessed. However, this is no disadvantage as the depth of features and innovation of tools and charts make the app a competition killer.

Charts and Indicators

Candle-stick, bar, and line charts can be accessed from WeBull. Each chart can be set to 1 minute intervals all the way to 60 minute intervals and can access the data of a stock up to 5 years ago. In addition, price and momentum indicators from exponential moving averages, Bollinger Bands to money flow index, MACD and RSI oscillators (through Advanced Charting mode) help improve price action interpretation.

Research

Too add onto ways to gather information for your investments, WeBull provides news streams with access to press releases, analyst recommendations, historical EPS and revenue data along with key statistics, insider holdings and transactions. Therefore, this is practically a fundamental investors dream.

Stock Screeners

Screeners provided by WeBull are intuitive and provide investors looking for something new and big a chance to find the biggest movers on the market. It has built in scanners that can search and access stocks like “Biggest Movers in Past 5-Minutes.”

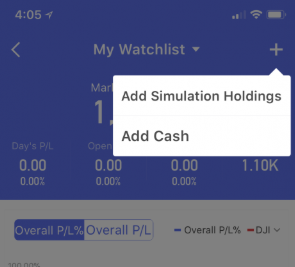

Watch List and Alerts

Users can put together multiple watch lists rather than some platforms that only allow one list. Additionally, WeBull provides alerts and SMS notifications, an esteemed tool used to notify users about movements on the market. These alerts can be triggered based on price changes or indicators.

Simulated Trading

Beginners who do not wish to test their luck with real money have access to their simulated trading. Rather than risking real money, trade with fake virtual money that is affected by real market movements and gain experience for future trades with real money.

It’s the perfect way to get acclimated and take off those training wheels for real trading.

Summary

To summarize WeBull, a compiled list of pros and cons has been assembled to weigh out whether or not WeBull suites your needs.

Pros

- Free demo account trading and real-time U.S. stock and ETF quotes

- Powerful research tools including news streams, analyst guides, built-in and configurable stock screeners with Smart Alerts

- In-depth advanced charting with price and momentum indicators

- Short-selling available for margin accounts

- Zero-commission trades

- Multiple watch lists and article storage

Cons

- No options trading

- No Good-to-Cancel (GTC) limit orders

Bottom Line

Do not be intimidated by the more in-depth tools and charts offered by WeBull. Although it may come across as more confusing, the charts are essential to make predictions on the market. Utilize the simulated trading to gain experience and confidence in your decisions.

It’s perfect for experienced regular investors and beginners who are willing to take the time to learn.

If you’re interested, be sure to create an account using our referral link! Signing up with this link will grant you a free stock valued between $5-$100!