It’s very common for people to use a rewards card that racks in points, miles, and other bonuses over time. The more you spend, the more of these points you receive. Unfortunately, there’s a number of large expenses – such as mortgage, utility bills, and payments – that don’t allow payment via credit card, which in turn prevents you from earning your points.

It’s very common for people to use a rewards card that racks in points, miles, and other bonuses over time. The more you spend, the more of these points you receive. Unfortunately, there’s a number of large expenses – such as mortgage, utility bills, and payments – that don’t allow payment via credit card, which in turn prevents you from earning your points.

As a result, a new alternative payment method, called Plastiq, has been created. This company created a simple yet intuitive way of paying bills and making payments that allows customers to still earn their rewards.

If you’re already interested, be sure to sign up using our referral link! This link makes your eligible for a $500 Fee Free Bonus after reaching a spending requirement. Don’t miss out on this chance to earn free money for your next payment cycle.

What Is Plastiq

Plastiq is a service that allows their customers to pay bills with credit cards, even where cards are not accepted by the lender, creditor, or vendor. Such payments include, monthly bills, mortgage, utilities, and other uncommon payments like tuition, and even income taxes!

Business owners can also use Plastiq for expenses used on the company, like supplies, market materials, and any other expenses. The recipients of your payments will receive funds with your name, account, and invoice number on them. That way, the recipient knows the payment is coming from you or your company.

How Does It Work

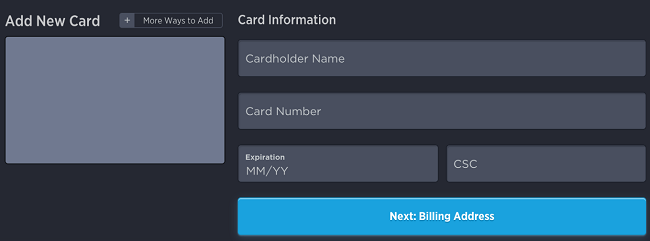

Using Plastiq to pay your bills is a simple process. Simply provide information of the recipient, including name, address, and payment amount.

Plastiq will then charge your credit card and you’ll receive the rewards you deserve. Because the charge goes in as a purchase, you’ll avoid cash advance fees that may be charged by your card provider.

Each transaction comes at a cost though. Plastiq charges a 2.5% processing fee for credit cards, prepaid cards, and gift cards. Debit cards will be charged at a rate of 1%. From time to time they will offer promotions that allow customers to be charged a lower rate but conditions may apply.

How To Maximize With Plastiq

With a 2.5% charge for its service, you have to think a little critically to make Plastiq work for you. Any instance in which you choose to use Plastiq should justify that 2.5% service charge.

Below are a few examples of good situations to use Plastiq.

When Rewards Exceed 2.5%

If the rewards of your purchase exceed the 2.5% processing fee, using Plastiq makes sense. For example, for the first year, a Discover It card can receive 3% bonus points. So if you make payments using that card, you’ll earn a net gain of 0.5% which may not seem like a lot, but it’s better than nothing.

Earning a Status

Say there is a yearly spending requirement of $30,000 in order to receive elite status from your co branded card. It’d be smart to using plastiq as a method to reach the status if you’re already close to it. However, we don’t recommend using Plastiq for the entire spending requirement. Processing fees will total up to $750 which wouldn’t make the status worth it in the end.

Referral Program

By signing up with our referral link, you’ll be eligible for a chance to receive a $500 Fee Free Bonus. Meaning when you spend $500 you’ll be able to make the transaction fee free!

What Card are Eligible

Plastiq works with Visa, Mastercard, and American Express credit cards. This includes debit cards as well. Additionally, Visa, Mastercard, and Amex gift cards are accepted as well. Mastercard and Discover can be used for all payees, including mortgage payments. Visa works for almost all payees, except for mortgages.

Bottom Line

Plastiq is a service that allows their customers to pay bills with credit cards, even where cards are not accepted by the lender, creditor, or vendor. Their intuitive system is simple, yet effective and helps their customers earn their rewards. However, this is a very situational service. If the rewards outweigh the costs and processing fees, without a doubt it’s worth using Plastiq.

If you’re interested in using this service, be sure to use out referral link! This link will make you eligible to earn a $500 fee free bonus that waives you from any processing fees for purchases of $500 or more!